There too many people who owe the Internal Revenue Service a considerable amount of tax and this has never happened in history before until today. This is a problem that most people would do anything for just to get it off their names; this is how severe the problem is. You can reduce the amount you owe from the Internal Revenue Service through offer in compromise, collection appeal, collection due process, innocent or injured spouse defense or installment agreement. The methods above are just a few of the instruments that a CPA or tax attorney can use to help you set up your liabilities.

This type of question requires a considerable sum of money to get it fixed and remove the thorn in a lot of people’s backs. They offer in compromise, collection appeal, and innocent or injured spouse defense. These are just some of the other tools that professionals use to help their clients remove such immense back pains and this has to be fixed.

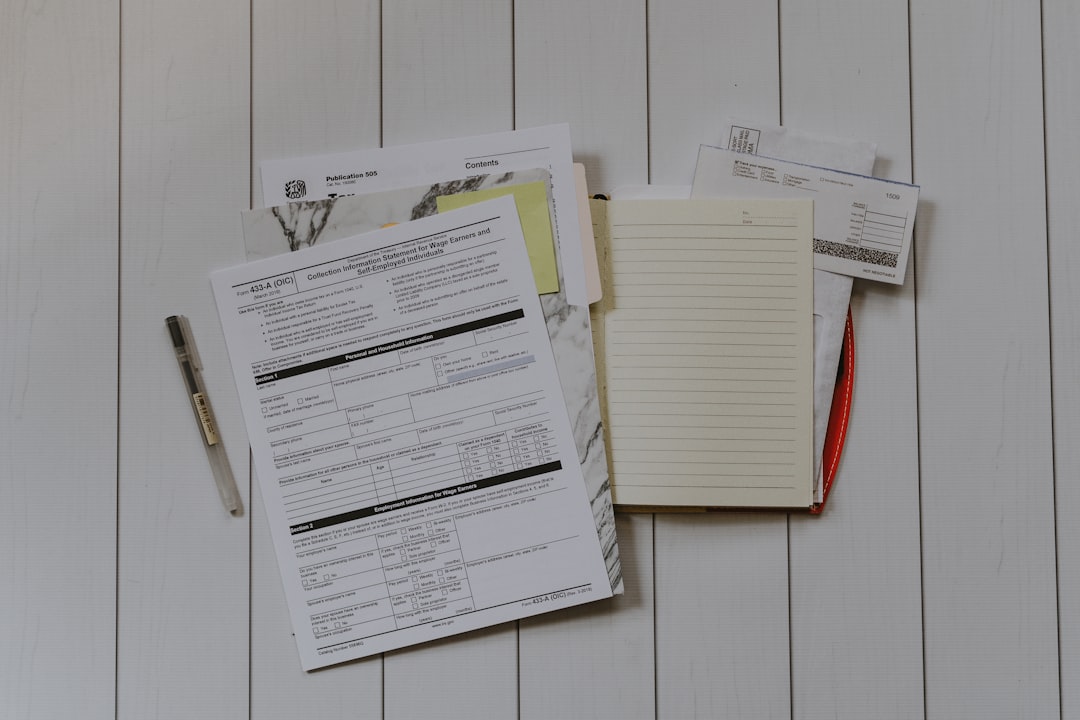

You have to make sure that you know what offer in compromise is before you agree with the Internal Revenue Service about it. The offer in compromise is how you get to pay half of the total amount that you actually owe the Internal Revenue Service. But just like anything good, there is still something wrong about it no matter how you look at it. You will be able to get a discount on the total amount that you owe the Internal Revenue Service from hundreds to even thousands of dollars. The discount comes with a catch; you have to disclose some information to the Internal Revenue Service about all your assets. All your taxes are being followed by the Internal Revenue Service machine which means there will be no escape for you. You will be having some problems with the Internal Revenue Service when they send people to knock at your client’s doors.

Tax debts can be quite a handful, and it is essential that you find a way to fix this type of problem; that is why you should make use of the Internal Revenue Service Tax Resolution Software. You can’t rely on pencil and calculator because this is going to be some severe calculations and without an Internal Revenue Service Tax Resolution Software, you can’t find the right computation to fix things. You have to make sure that you prepare a successful case because it is the Internal Revenue Service you are dealing with, and they will never back down without a fight. This is why you need the Internal Revenue Service Tax Resolution Software to help you out and save time in preparing for your case.